Seller Concessions Spike on Listings Sold Between $200K-$250K

Price Reductions up 27% on Active Listings Between $250K-$400K

For Buyers:

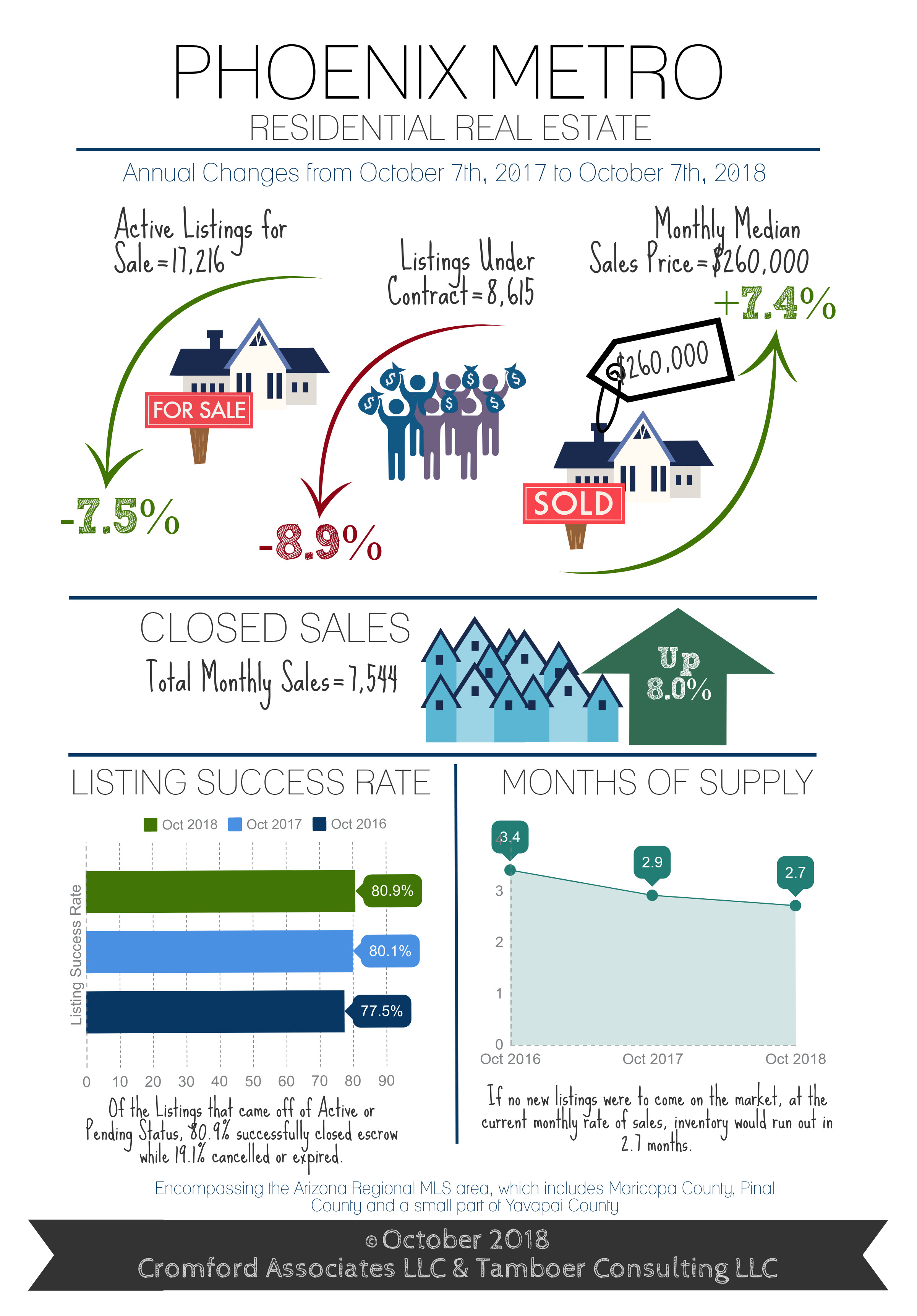

October marks the 4th month in a row that supply has continued to rise between $200K – $400K, which is good news for many buyers as it provides them with more choice and fewer competing offers. However, for those buyers with budgets under $200K, this trend in supply doesn’t apply to them and their choices are still extremely limited. Last January, inventory under $200K made up 18% of all active listings. Within that price range, single family homes made up 50%, condos and townhomes 30%, and mobile homes 20%. As of this month, inventory under $200K only makes up 12% of actives and has declined 36% since January. Single family homes make up 45%, condos and townhomes 36%, and mobile homes 19%. This drop in supply equates to 591 fewer single family homes, 198 fewer condos and townhomes, and 229 fewer mobile homes available for sale under $200K since the beginning of 2018.

For Sellers:

When supply rises, sellers react in a number of ways to compete with one another for the existing buyer pool. One option is a price reduction on their active listing prior to contract. This does not necessarily result in a decline in sale price, only a decline in sellers’ expectations for appreciation. Sales price trends may still continue to rise, but perhaps only at 5% instead of 8%, for example. Another option is to agree to a concession, such as paying a portion of closing costs or a home warranty; and finally to agree to a much lower sale price than what they were asking. Typically sellers agree to the first two options before submitting to a “low ball” contract, which is why sales price trends are the last measures to respond to a shift in supply and demand. With that being said, weekly price reductions this month between $250K-$400K are up 27% compared to last year, while price reductions between $200K-$250K are only up 1.7%. However, seller concessions on sales between $200K-$250K reached 41% so far this month compared to last quarter’s measure of 36%. Only 21% of sales between $250K-$400K recorded a seller concession. Which leads us to conclude that sellers below $250K are agreeing to more concessions than price reductions; while sellers over $250K are submitting to more price reductions. Despite this slight weakening in sellers’ advantage, Greater Phoenix is not close to a balanced or buyer’s market so expect overall prices to continue rising over the next 3-6 months.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2018 Cromford Associates LLC and Tamboer Consulting LLC