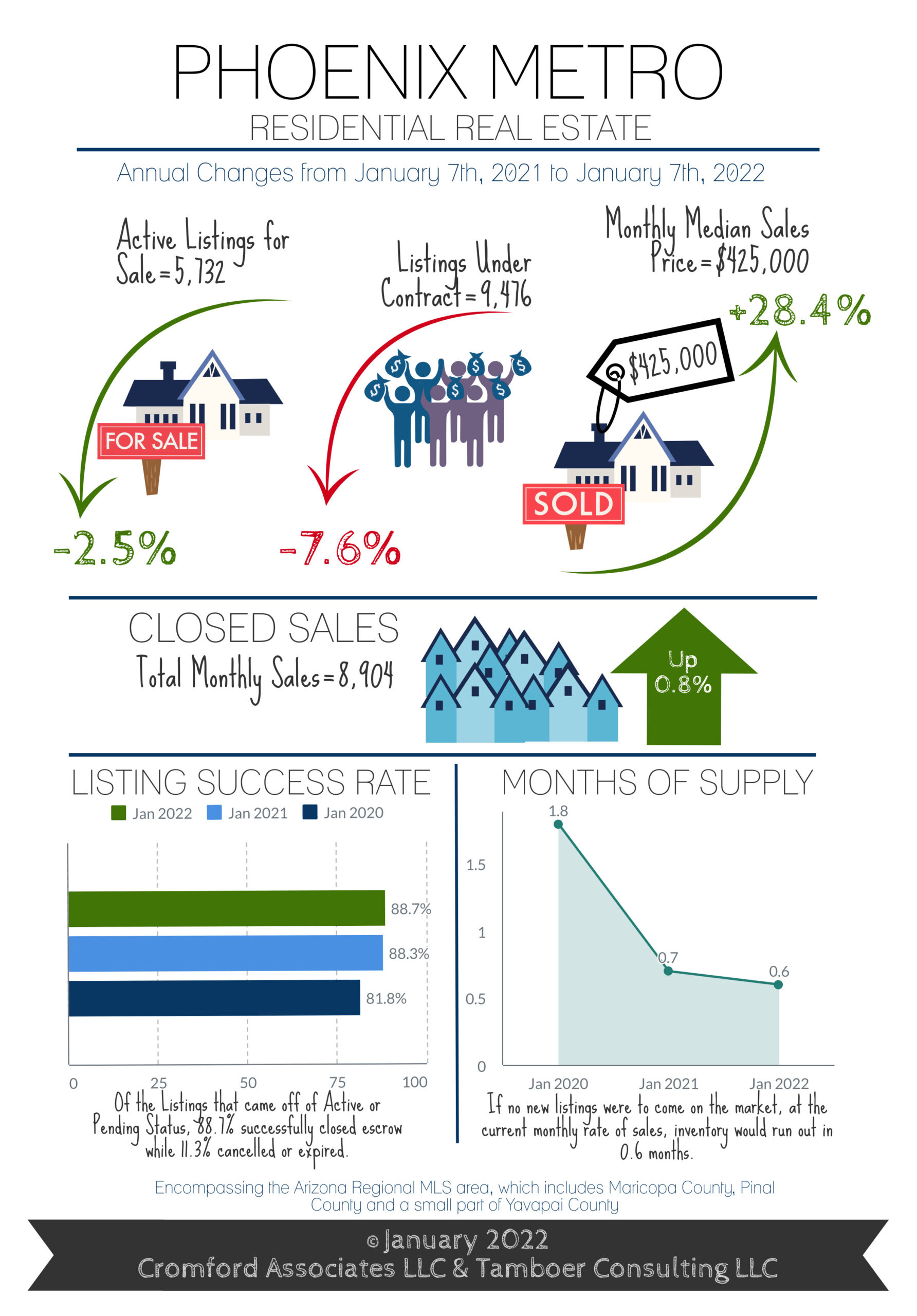

Despite rumors of the U.S. housing market cooling off, Greater Phoenix has moved farther into a seller’s market over the past month. Growing disparity between supply and demand in our market means there is little evidence to suggest price appreciation will slow in the first quarter. After a strong summer, new listings slowed down in the 4th quarter of 2021, while the number of accepted contracts remained high. The result is 2022 starting off with another historically low supply level, and listings under contract, while 7.6% below 2021, still strong with the 2nd highest count since 2014.

It’s an accepted opinion among local analysts that income levels in Greater Phoenix cannot sustain another year of 28% annual appreciation, especially if interest rates continue to increase. However, seeing there is little relief from home builders adding more supply to the equation, it’s reasonable to expect the market to respond with a softening of demand. This trend started to reveal itself in the 2nd Quarter of 2021 in a subtle manner.

Since 2014, buyers purchasing their primary residence have made up 70%-76% of total residential purchases in Maricopa and Pinal County. In Q2 2021, that percentage dipped to 67%, and declined to 63% by October. While traditional buyers retreated, competing buyers for 2nd homes and institutional buyers made up of Wall Street-backed iBuyers, hedge funds and other investment groups stepped in. Price appreciation slowed from an average of 3.3% per month to 1.1%.

While 2022 is coming out of the gate strong, and the Spring is typically the strongest season for buyers, it remains to be seen how much control investors and 2nd home buyers will take if traditional home buyers retreat. The last time they ignored affordability issues within the community, everyone lost in the end.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2022 Cromford Associates LLC and Tamboer Consulting LLC