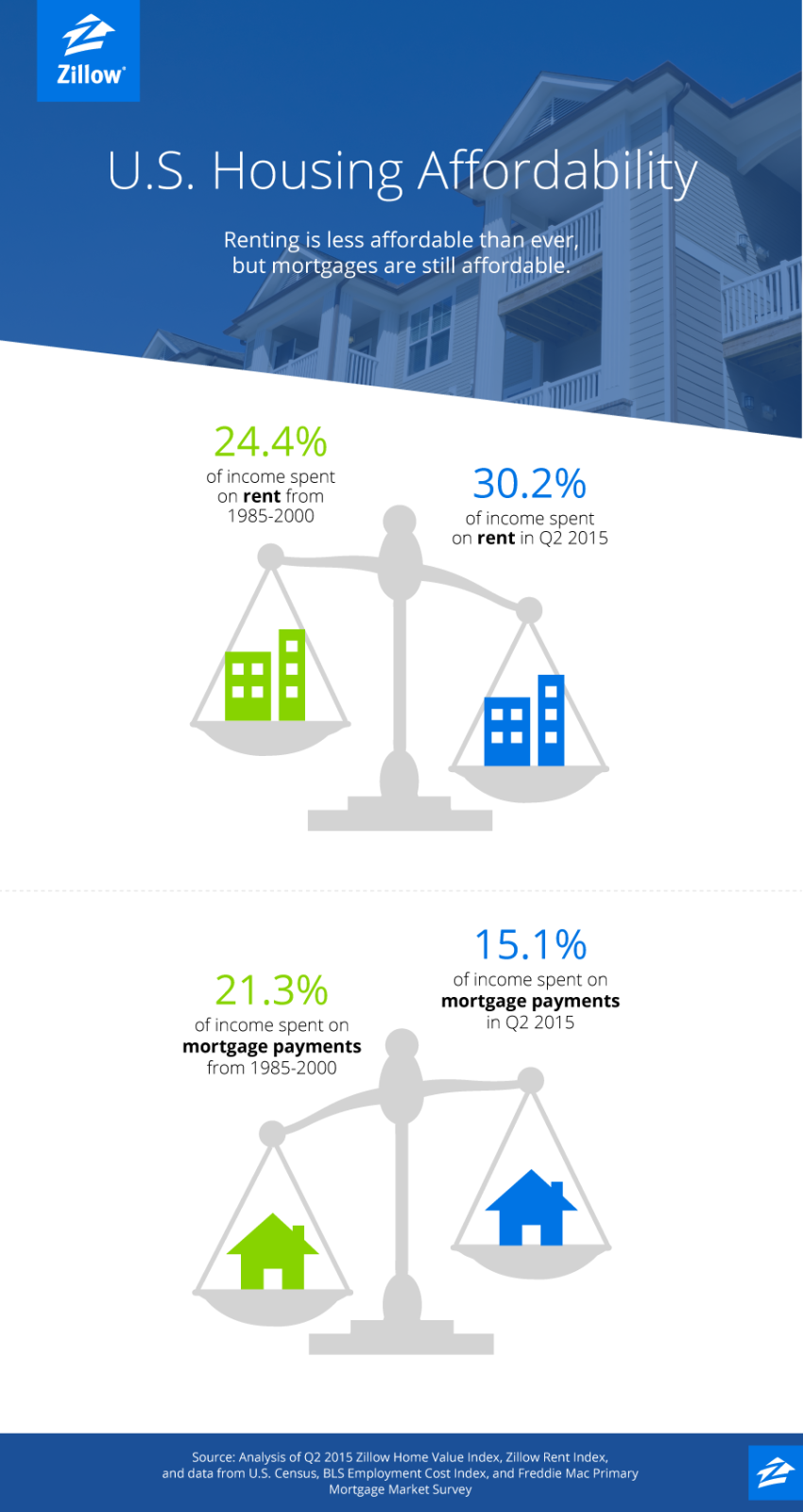

Homeownership More Affordable Than Renting

Current renters spend roughly 30 percent of their household income on housing; home buyers spend about 15 percent of their monthly income on a mortgage payment for a typical home.

Spending a bigger piece of the income pie on rent makes it hard to save for a down payment.

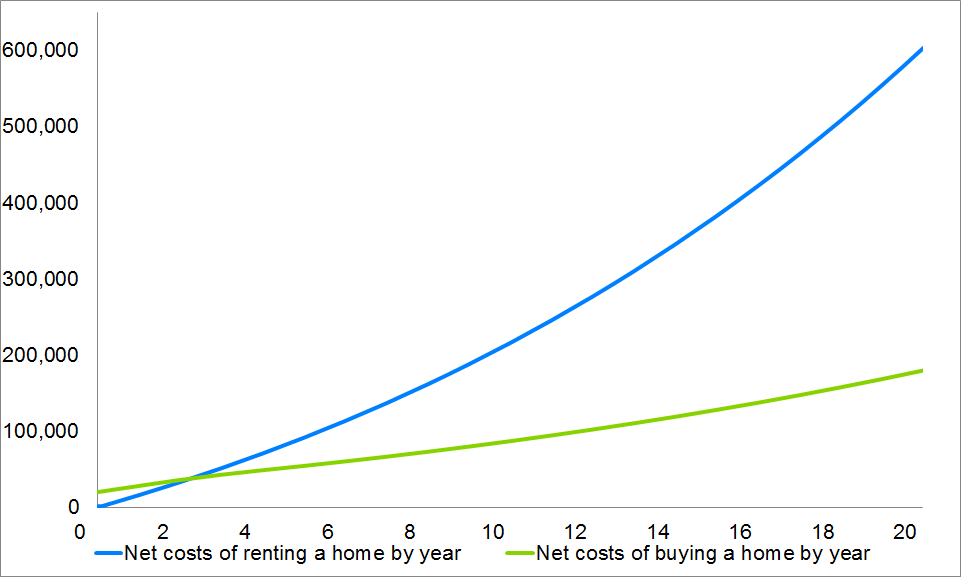

Although 20 percent is a recommended down payment, the graph below shows that even assuming only 5 percent down and a 6 percent mortgage interest rate, the breakeven horizon is just short of four years, and rental costs are still remarkably higher than homeownership costs by approximately $300,000 over 20 years.

With 5% down and a 6% interest rate, the breakeven horizon is just under 4 years.