Apr 29, 2014

Wall Street analysts expect home prices to appreciate in 2014 despite weak home sales during the 1st quarter.

Wall Street analysts expect home prices to appreciate in 2014 despite weak home sales during the 1st quarter.

Barclay’s analysts projection of a 7% increase in home prices remains unchanged and actually raised its projection for Arizona from 6.8% to 8% and Florida from 7.7% to 8.3%.

Morgan Stanley acknowledged the sluggish spring start to the home-selling season across the nation but remain optimistic about the housing recovery. “We continue to expect home-price appreciation to moderate from the torrid pace of mid-2012 to 2013, supported by improving employment and growth prospects,” according to analysts from Morgan Stanley.

Source: “Wall Street Home Price Appreciation Still Expected to Hit 7%,” HousingWire (April 28, 2014)

Apr 11, 2014

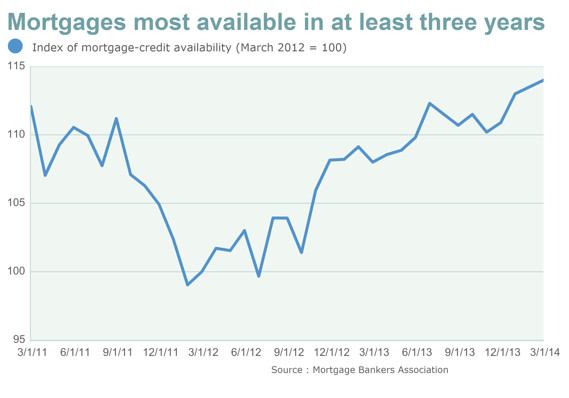

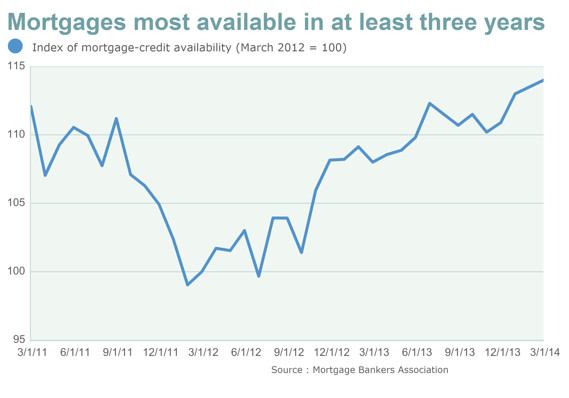

Based on the Mortgage Bankers Association (MBA) index which tracks the availability of mortgage-credit, the availability hit a 3 year high in March. While the availability of mortgages is no where near the levels of 2005-2006, there is a measured increase in borrowers access to mortgage credit. The buyers most positively impacted by the credit easement are those seeking jumbo loans and prime purchase mortgages.

Based on the Mortgage Bankers Association (MBA) index which tracks the availability of mortgage-credit, the availability hit a 3 year high in March. While the availability of mortgages is no where near the levels of 2005-2006, there is a measured increase in borrowers access to mortgage credit. The buyers most positively impacted by the credit easement are those seeking jumbo loans and prime purchase mortgages.

Source: “Mortgage Credit Most Available in at Least Three Years, Gauge Says,” The Wall Street Journal (April 9, 2014)

Apr 9, 2014

The top end of the luxury market in Greater Phoenix continues to outperform last year by a huge margin.

The first quarter of 2014 dollar volumes for high end sales through ARMLS were as follows:

- List price over $3 million = $100 million versus $58 million last year – up 72% and by far the highest dollar volume since Q1 2008

- List price from $2 million to $3 million = $87 million versus $61 million last year

- List price $1.5 million to $2 million = $91 million versus $119 million last year – a weak spot

- List price $1 million to $2 million = $181 million versus $161 million last year

The total spent in Q1 2014 for homes over $1 million was $459 million, an increase of 15% over last year. This was entirely due to the performance of the top priced segments. If we look only at homes over $2 million the increase was 57%, but between $1 and $2 million the dollar volume was actually down slightly by 3%. Dollar volume for homes priced between $500,000 and $1 million was flat at $574 million in both Q1 2013 and Q1 2014.

Meanwhile the rest of the market priced at $500,000 and below declined by 10% in dollar volume.

The top end is off to another flying start in April with $21 million closed in the first 4 days for homes listed over $2 million. Q2 2013 was a very strong period for luxury home sales and $209 million was spent on homes over $2 million, the highest quarterly total since Q2 2008. With the current momentum it looks like Q2 2014 has a real chance of breaking through that number.

Source: Cromford Daily Observation

Wall Street analysts expect home prices to appreciate in 2014 despite weak home sales during the 1st quarter.

Wall Street analysts expect home prices to appreciate in 2014 despite weak home sales during the 1st quarter.